Featured Blogs

Advanced thermal management

Engineered materials deliver advanced thermal management qualities.

Wearable health monitors

Bio-sensing functions are a cornerstone of modern health monitors.

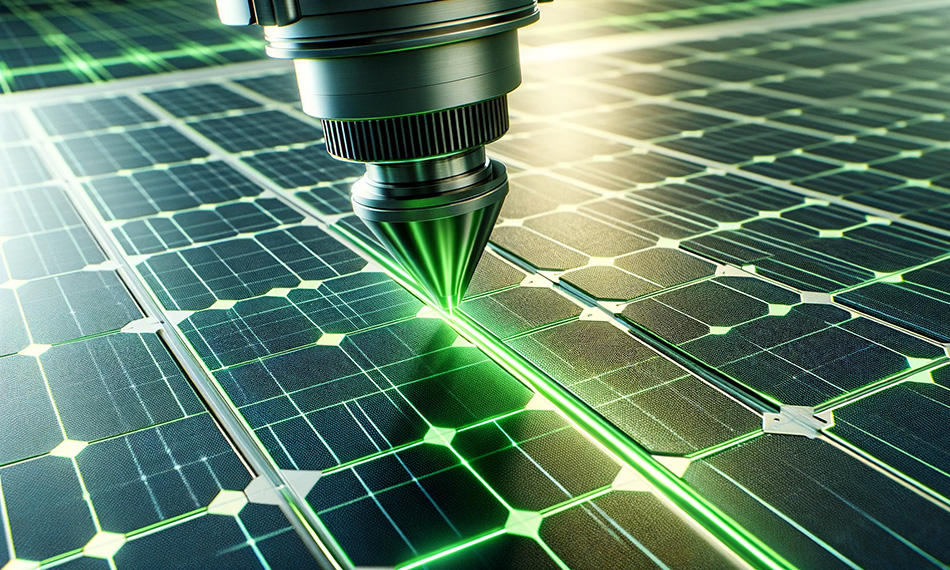

Glasgow : Ultrafast lasers

Coherent Glasgow is the center for our ultrafast laser manufacturing.

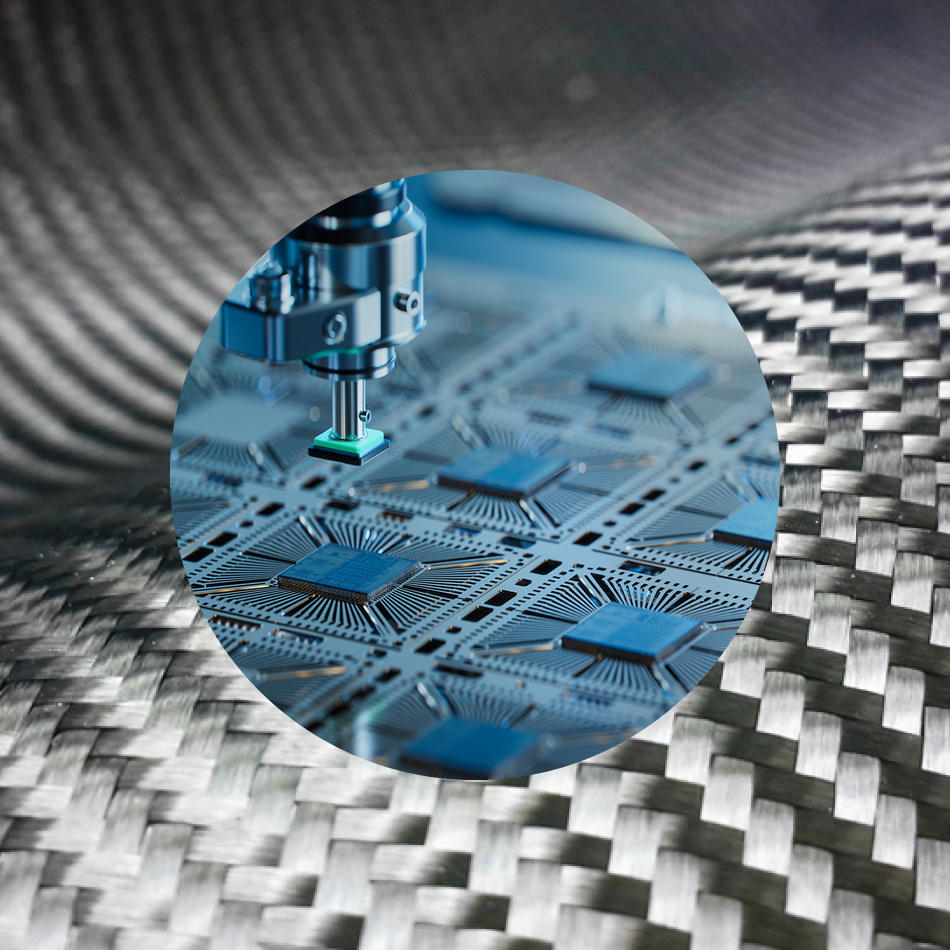

Ion implantation foundry services

Integral to semiconductor and engineered materials manufacturing.

Featured Solutions

Featured Event

CYTO 2024

May 4 - 8, 2024

Edinburgh, Scotland

CYTO is the premiere showcase for cytometry-related technologies, featuring some of the top biological, engineering, and environmental companies in the world. Visit CYTO to see the most recent innovations and meet the industry's thought leaders, decision-makers, and scholars.

Featured Products

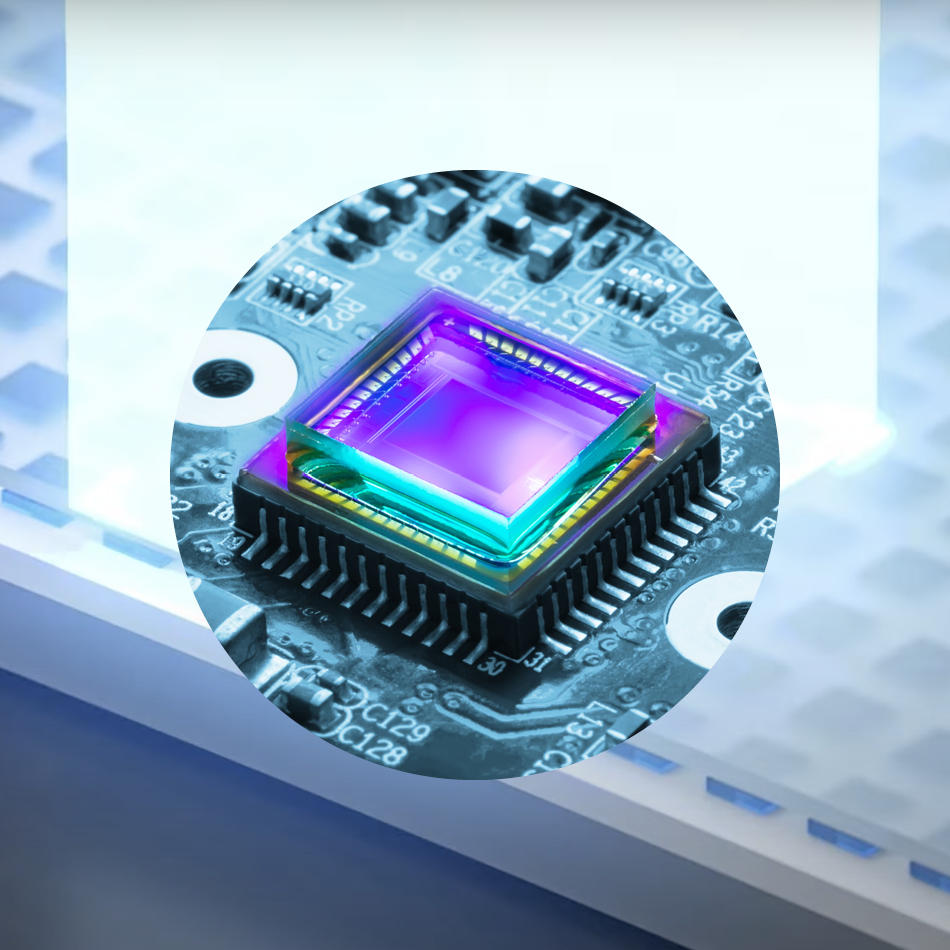

MATERIALS FOR OPTICS, PHOTONICS, AND ELECTRONICS

Get the highest-quality materials and secure supply chain resiliency from the recognized leader.

Coherent Careers

Our multidisciplinary team of scientists and engineers radically reimagine what’s possible by creating custom solutions for our clients.

Coherent Labs

Solving the most difficult manufacturing challenges with thought leadership and innovative laser systems solutions. Our experts engage customers on over 2,500 projects per year.

Shop Coherent

Online shopping for lasers, optical fibers, power meters and sensors, accessories, and much more on Coherent online has never been easier.